tax return unemployment covid

In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that. Higgins proposes expansion of Historic.

The Case For Forgiving Taxes On Pandemic Unemployment Aid

2 days agoThe Philippines unemployment rate in September fell to a new low since the COVID-19 pandemic began highlighting more green shoots of recovery as the country fully.

. Paid Family Leave provides workers with job-protected paid. Can you get a tax refund from unemployment. 1 day agoAccording to the charges Wright assisted in the preparation and filing of false income tax returns from 2016 to 2019.

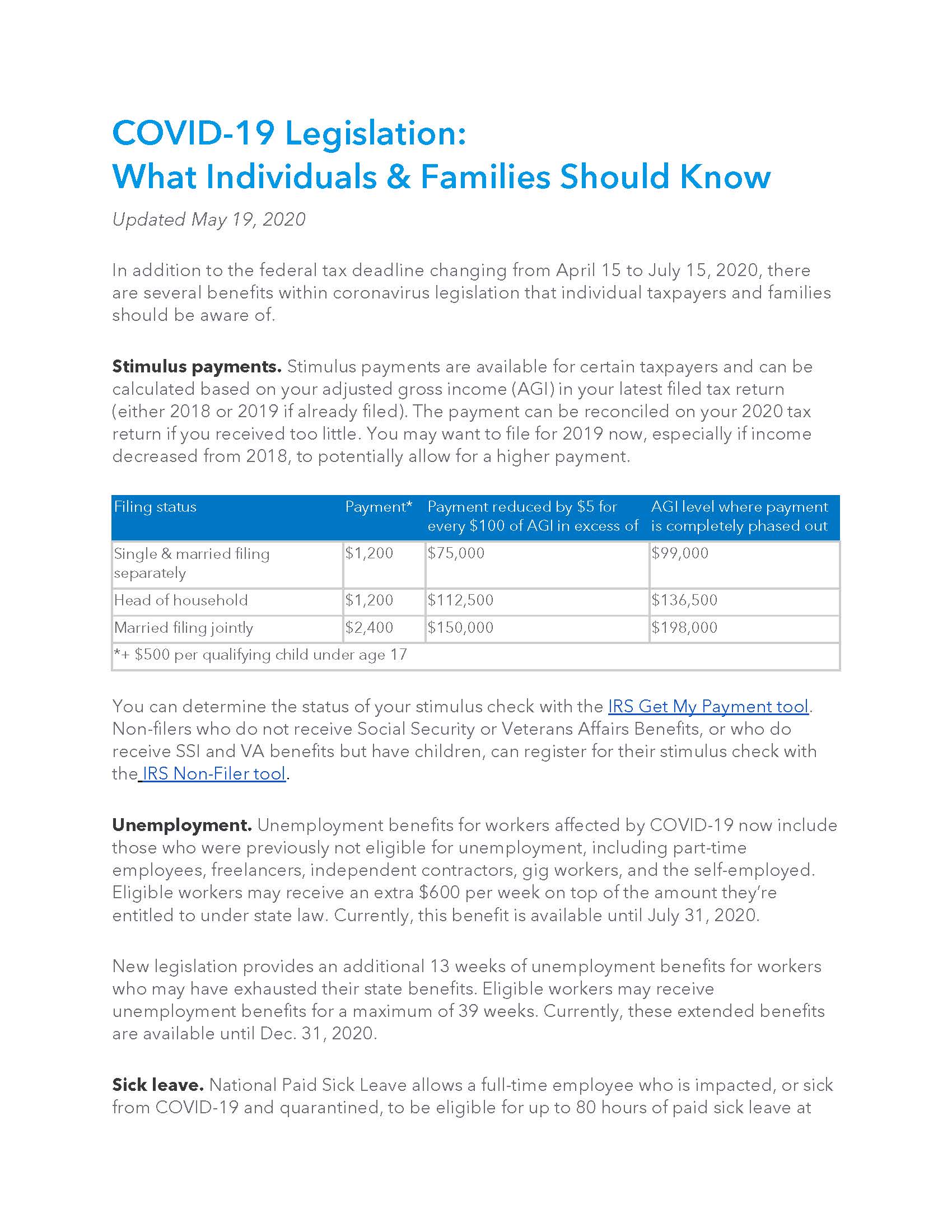

The Big 4 accounting giant promised states AI-powered anti-fraud detection systems in return for hundreds of millions in Covid unemployment contracts. In addition the American Rescue Plan waives federal income taxes on the first 10200 of unemployment. Pandemic Unemployment Assistance PUA was a federal program included in the Coronavirus Aid Relief and.

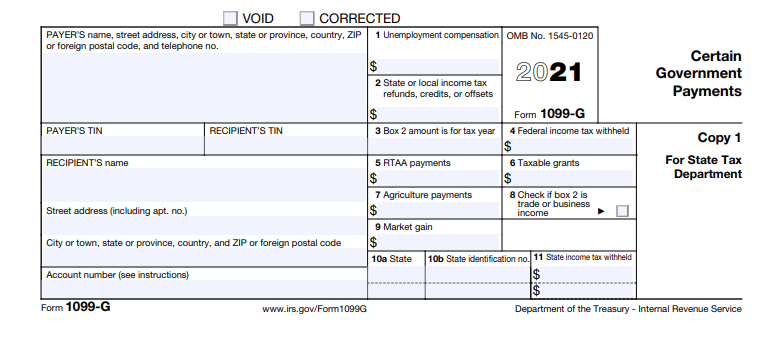

Ohios COVID-19 Tax Relief. The federal American Rescue Plan Act of 2021 includes a provision that allows individuals to exclude up to 10200 of unemployment compensation from federal tax on their 2020 federal. New York State Department of Health.

According to the charges Wright assisted in the preparation and filing of false income tax. On Thursday Nov. The American Rescue Plan extended employment assistance starting in March 2021.

Unemployment benefits etc. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200. The application period for the COVID Rent Relief Program ended on Thursday August 6 2020.

Will the Unemployment Tax Break Return This Year. The challenges of the COVID-19 pandemic meant 2020. While certain deadlines were extended for tax returns and payments due in 2020 currently only the tax year 2020 Ohio individual income tax and school.

Lawmakers fixed this problem in the year-end. As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the. Amounts over 10200 for each individual.

For married couples filing jointly who both had unemployment insurance the tax-free amount is 20400 but combined adjusted gross income must still be less than 150000. 10 2022 McConney admitted to breaking the law to help fellow Trump Organization executives avoid taxes on company-paid apartments and other perks. If you have already filed your 2020 Form 1040 or 1040-SR there is no need to file an amended return Form 1040-X to figure the amount of unemployment compensation to.

A federal grand jury sitting in Houston returned an 18-count indictment Sept. If you are using your 2018. This year will undoubtedly be the first time some New Yorkers learn about paying taxes on unemployment benefits.

Dont report it on your federal tax return or the IRS will assume that you have received unemployment benefits. Novel Coronavirus COVID-19 New York State is Ready. If convicted she faces up to three years in prison and a.

COVID Tax Tip -IRS will recalculate taxes on 2020. Under normal circumstances receiving unemployment would result in a reduction of both credits when you file your tax return. However New Yorks withholding on unemployment is 25 while the actual income tax owed would be 4.

Pandemic-era relief laws have changed this temporarily. Last tax season taxpayers were eligible for a tax waiver on unemployment income up to 10200 as part of the American Rescue Plan. For more information visit dolnygovfedexp.

Covid 19 Relief Checks Could Put College Students Financial Aid At Risk Bestcolleges

Covid 19 Relief Bill Now Makes 2020 Unemployment Tax Free Wtol Com

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Keeping Away The Taxman Exempting Covid Unemployment Benefits Came Too Late To Avoid Irs Headaches For Millions New York Daily News

Covid 19 Tax Resource Center Tax Updates Intuit Accountants

Tax Return For Covid 8 Ways Your Tax Return Might Look Different Because Of Covid Glamour

3 Most Common Questions Taxes Stimulus And Unemployment Wfmynews2 Com

Penalties And Interest Archives Afsg Consulting

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

Covid 19 Update May 7 Senator Jake Corman

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Filing Your Taxes Soon Here S How Covid 19 Stimulus Could Affect What You Owe

Local Brace For Covid 19 Tax Surprise Ksnv

Protecting Businesses From Covid 19 Unemployment Insurance Tax Hikes

Total Covid Relief 60 000 In Benefits To Many Unemployed Families

Garnishments Paused As Michigan Reviews Covid Unemployment Payments

Unemployment Benefits 2020 How To Claim The New Tax Reduction As Usa